Family offices often wonder how they stack up against their peers in terms of asset allocation, technology, operational challenges and other issues that can impact not only day-to-day business but also long-term success.

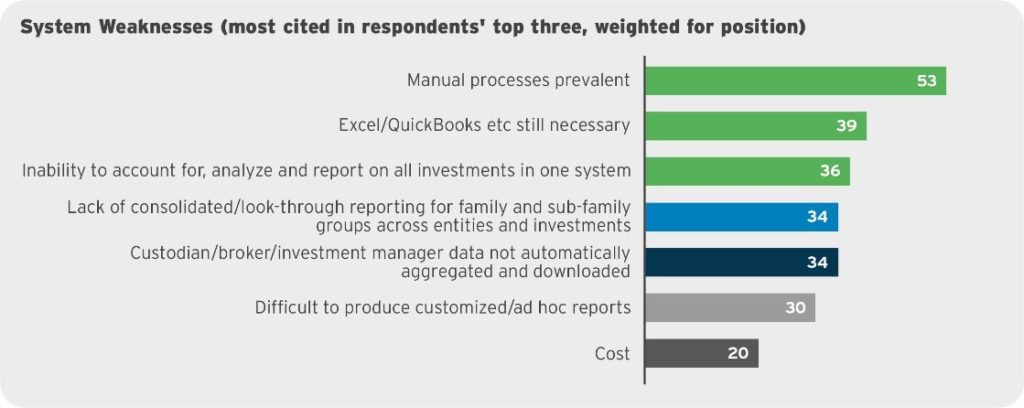

A new in-depth study by Family Wealth Report produced in partnership with FundCount, examines the key technological and operational challenges specific to family offices. Based on a detailed survey of firms worldwide managing over $72 billion in assets, Efficiency in Accounting and Investment Analysis provides invaluable benchmarking insight for family offices.

On the Road With FundCount

FundCount has participated as a sponsor and presenter at several conferences over the past quarter. Operational efficiency was the overarching message at all events.

At the Lido Family Office Investment Symposium in Santa Monica, California, COO Mike Slemmer spoke on “Alpha Ignored? Rethinking Family Office Operations and Technology.”

In the session, he discussed the many costs of inefficient operations, including missed opportunities from lack of investment insight.

Later in March, at the FWR Fintech Summit, FundCount partnered with Family Wealth Report to launch the research study, “Efficiency in Accounting and Investment Analysis.” Based on a survey of 44 single and multi-family offices globally and in-depth interviews with senior executives, the study provides a comprehensive look at the operational and technological challenges of family offices.

At the Marcus Evans Private Wealth Summit in Boston, FundCount client Marcie Odum of the Lupton Company spoke on “Challenges and Successes in Managing Operational Change.”

And finally, in April, FundCount sponsored the Palm Beach Global Financial Forum in Florida. At this hedge fund/fund administration conference, FundCount led a roundtable on “Optimizing Fund Administration and Hedge Fund Operations.”

Look for FundCount at the following upcoming events:

- Family Wealth Alliance WealthTech Symposium

June 13, Chicago - Global Family Office Conference

June 13, London

Client Quote of the Quarter

“FundCount has helped drive improvements in the speed and depth of reporting, making slicing and dicing the portfolio by any dimension, such as asset class or asset manager, instant and improving the monitoring of mandates.”

— New Jersey-based single family office

New Clients

FundCount is pleased to announce the addition of two new clients, Sanlam and Fidelity Financial Services.

Sanlam is a South African headquartered diversified financial services business operating across the globe. With more than 100 years of experience behind it, Sanlam understands the need to deliver efficiency and transparency for its clients. Sanlam recognized the ability of FundCount to do this out of the box, setting its new Mauritius-based Fund Administration business on the right path from day one.

Fidelity Financial Services, a fund administration firm based in New Jersey, manages private equity and hedge fund clients. Hiring and retaining staff has been a major challenge for the firm. They selected FundCount to leverage data integration to drive process automation, thereby reducing the need for headcount. Their strategic goal is to grow and scale without adding staff.

Awards and Accolades

FundCount is pleased to to have won the following awards:

- WealthBriefing European Awards

Best Client Accounting Solution - FinTech Global: WealthTech 100

FundCount earned a spot in the top 100 listing of the most innovative WealthTech companies

Welcome Aboard

FundCount’s commitment to continued product enhancement is reflected in the company’s ever-growing development team. We’re pleased to welcome two developers and a technical writer to the FundCount family.

About FundCount

Founded in 1999, FundCount provides integrated accounting and investment analysis software that improves operational efficiency and delivers immediate, actionable intelligence to clients around the globe. Today, over 125 hedge funds, single and multi-family offices, fund administrators and private equity firms worldwide with assets totaling more than US $150 billion rely on FundCount for accurate, timely information and flexible reporting. FundCount supports its growing client base from the company’s U.S. headquarters and four additional international locations.